[share_icons]

52-Week High: ₹75.17

52-Week Low: ₹59.53

Current Market Price (CMP): ₹72.50 (approx.)

Buying Zone: ₹72–₹74

Stop-Loss: Below ₹65

Target (12–15 months): ₹120–₹150

Technical Outlook: Timing and Patterns

- Proximity to Strong Support (~₹60): NMDC is trading significantly above its strong support near ₹60, which has acted as a reliable floor. That base may offer a launching pad for a substantial upside run.

- Trendline Break and Sustain: On the weekly chart, NMDC had been rising along an ascending trendline. Recently, it has broken above this line and is sustaining higher levels—indicating strength and signaling potential momentum continuation.

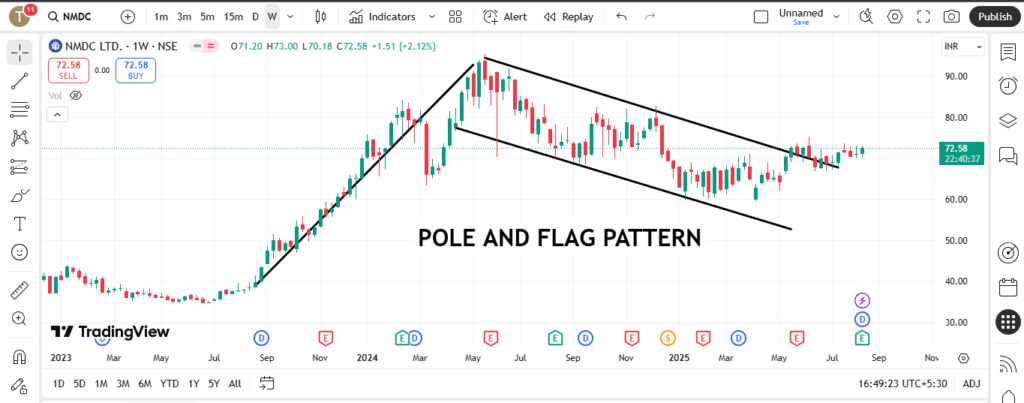

- Pole-and-Flag Breakout: A classic pole-and-flag pattern is visible: after a vertical rise (“pole”), the stock consolidated in a tight range (“flag”). A breakout above the flag with sustained price levels now points to renewed bull interest, enhancing confidence for new positions.

Company Snapshot & Fundamentals

Overview & Market Position

NMDC Ltd (National Mineral Development Corporation) is India’s largest iron ore producer and a Navratna PSU under the Ministry of Steel. It operates mechanized mines in Chhattisgarh and Karnataka and the only mechanized diamond mine in the country (Panna, MP) WikipediaGroww.

Market Cap & Valuation

- Market cap stands between ₹62,000–₹63,800 crore ScreenerMarketsMojoMoneycontrolDhan.

- NMDC’s trailing P/E ratio is low at ~9.5×, well below sector average (~12–15×) MoneycontrolUnivestGuruFocusDhan.

- Price-to-Book (P/B) ratio is around 2.1×, considered modest relative to peers Finology TickerGrowwDhanValue Research Online.

Profitability & Margins

NMDC’s profitability is strong:

- Net Profit Margin: ~28%

- Return on Equity (ROE): ~23%

- Return on Capital Employed (ROCE): ~30% Moneycontrol.

Financial Health

- Debt-to-Equity ratio is low at 0.13×, indicating minimal reliance on debt The Economic TimesMoneycontrol.

- Current ratio is healthy at ~2.4×, underscoring strong liquidity The Economic TimesMoneycontrol.

Recent Performance

- In FY 2024–25, NMDC reported a 17.4% rise in consolidated net profit to ₹6,538.8 crore, while revenue increased to ₹25,498.8 crore The Economic Times.

Shareholding Pattern

- Promoter (Government of India) holds ~60.79% equity Value Research OnlineWikipedia.

- Institutional holdings: FIIs about 12%, DIIs around 14.5%, and public & others (~10–11%) Dhan.

Strategic Investment Thesis

1. Compelling Technical Confluence

The ₹72–₹74 zone offers a favorable entry point: just above sturdy support at ₹60, following a trendline breakout, and confirming the classic bullish pole-and-flag breakout—all pointing toward strong upside potential.

2. Undervalued with Solid Earnings

With a P/E under 10× and P/B near 2×, NMDC offers value for a fundamentally strong mining company. Profits are robust, debt is low, and margins healthy.

3. Strong Government Backing & Liquidity

Backed by the Indian government as a Navratna PSU, NMDC benefits from policy support and capital stability—a valuable edge in cyclical industries.

4. Growth Delivery

Double-digit profit growth, improving revenue, strong cash generation, and low leverage suggest NMDC is on solid growth footing.

Investment Setup

- Buy Zone: ₹72–₹74

- Stop-Loss: Below ₹65

- Target: ₹120–₹150 over 12–15 months, implying upside of ~66%–100% from CMP.

- Risk Management: Use disciplined position sizing and monitor global crude/steel prices which influence iron ore markets.

Summary Table

| Metric | Value / Insight |

|---|---|

| CMP | ~₹72.5 |

| Buying Zone | ₹72–₹74 |

| Stop-Loss | Below ₹65 |

| Target (12–15 mo) | ₹120–₹150 |

| Market Cap | ₹62k–₹64k crore |

| P/E Ratio | ~9.5× (low) |

| Sector P/E | ~12–15× |

| P/B Ratio | ~2.1× |

| Net Profit Margin | ~28% |

| ROE / ROCE | ~23% / ~30% |

| Debt-to-Equity | ~0.13× |

| FY25 Net Profit Growth | +17.4% (to ₹6,538.8 crore) |

| Promoter Holding | ~60.8% (GoI) |

| FII Holding | ~12% |

| DII Holding | ~14.5% |