[share_icons]

Bajaj Healthcare Ltd. is increasingly catching the attention of long-term investors due to its strong fundamentals and recent bullish breakout in technical charts. With a 52-week high of ₹745 and a low of ₹330.9, the stock is currently trading near ₹517. Here’s a comprehensive analysis covering technical patterns, company fundamentals, market cap, promoter holdings, institutional interest, and future outlook.

Technical Analysis

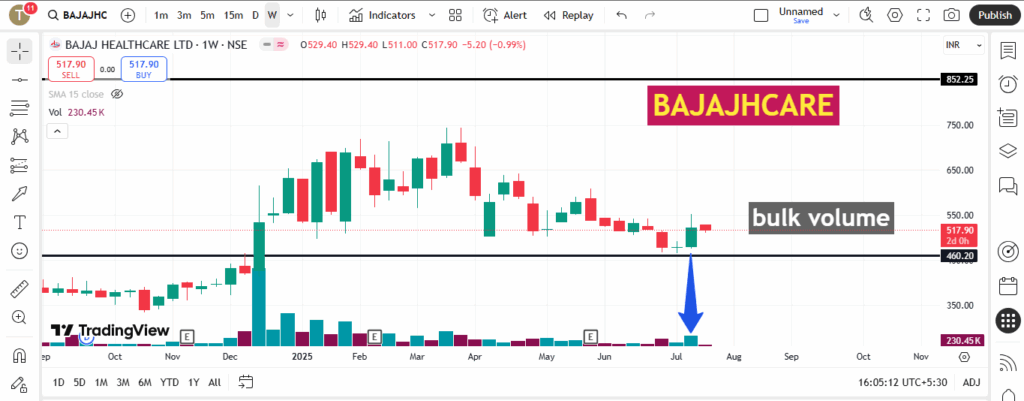

- Support and Psychological Levels:

On the weekly time frame, Bajaj Healthcare has formed a solid base around ₹450, which coincides with the psychological support of ₹500. This zone is expected to act as a strong support for long-term investors. A sustained hold above ₹500 will be a good sign for positional investors. - Trend Line Breakout:

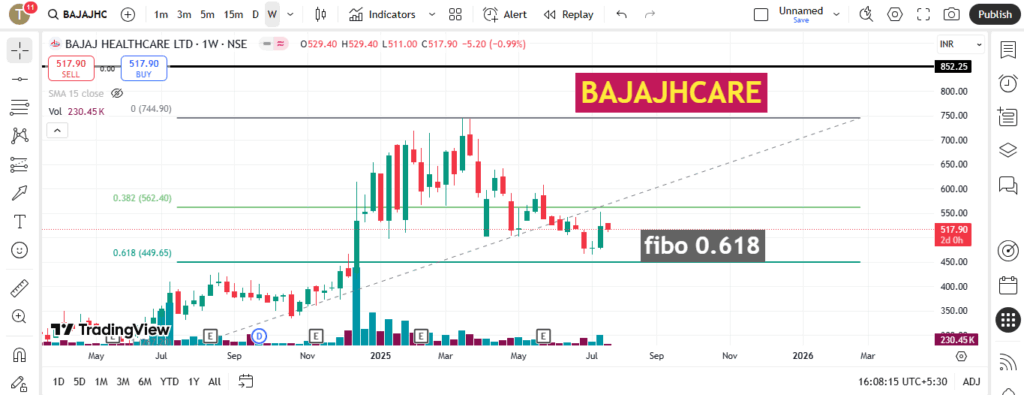

A bullish breakout of a descending trend line has been observed on the weekly chart with increased volume, indicating institutional interest and potential for further upside. - Fibonacci Retracement Level:

When drawing the Fibonacci retracement from the recent swing low to high, the stock has taken support around the 0.618 level, which is a golden ratio level often used by technical traders to identify strong reversal zones. - Buy Zone: ₹520–₹530

Stop Loss: Below ₹400

Target: ₹850+

Time Horizon: 8 to 12 Months

Company Profile: Bajaj Healthcare Ltd.

Bajaj Healthcare is a pharmaceutical and nutraceutical company engaged in manufacturing Active Pharmaceutical Ingredients (APIs), intermediates, and formulations for domestic and international markets. The company specializes in anti-malarial, anti-inflammatory, cardiovascular, and nutraceutical products.

Fundamental Analysis

- Market Capitalization: ₹700–800 Crore (Approximate; check current data)

Bajaj Healthcare is a small-cap company, which gives it significant growth potential but with a higher risk-reward ratio. - Debt Status:

The company is virtually debt-free, a positive sign for investors looking for financially stable businesses with lower interest burden. - Quarterly Financial Performance:

In the latest quarterly results, the company posted:- Revenue growth quarter-over-quarter.

- Profit margins improved, thanks to cost-cutting and better operating efficiency.

- EBITDA margins have shown gradual expansion.

- Return on Equity (ROE) and Return on Capital Employed (ROCE) have been improving, reflecting the company’s operational efficiency.

Shareholding Pattern (As per Latest Available Data)

- Promoters Holding: ~70%

Indicates strong confidence of the promoters in the long-term business prospects. - Public Holding: ~25%

A balanced public shareholding which indicates retail investor interest. - Foreign Institutional Investors (FIIs): ~2%

FIIs are gradually building positions, signaling global investor trust. - Domestic Institutional Investors (DIIs): ~3%

DIIs have shown minor but increasing interest in the stock.

Conclusion

Bajaj Healthcare offers a strong combination of technical breakout, debt-free status, improving financials, and high promoter holding. For long-term investors, the zone between ₹520 to ₹530 offers a good opportunity with a potential upside toward ₹850+ in the next 8 to 12 months.

This content is for informational purposes only and should not be construed as investment advice. Please do your own research or consult your financial advisor before making investment decisions.