Enviro Infra Engineers Ltd (EIEL), currently at ₹280, appears poised for a bullish breakout above ₹400 in the next 6–8 months. Discover its support levels, rising volume, strong Q4 numbers, debt-free status, and promoter confidence in this detailed stock analysis.

1. Stock Technical Outlook

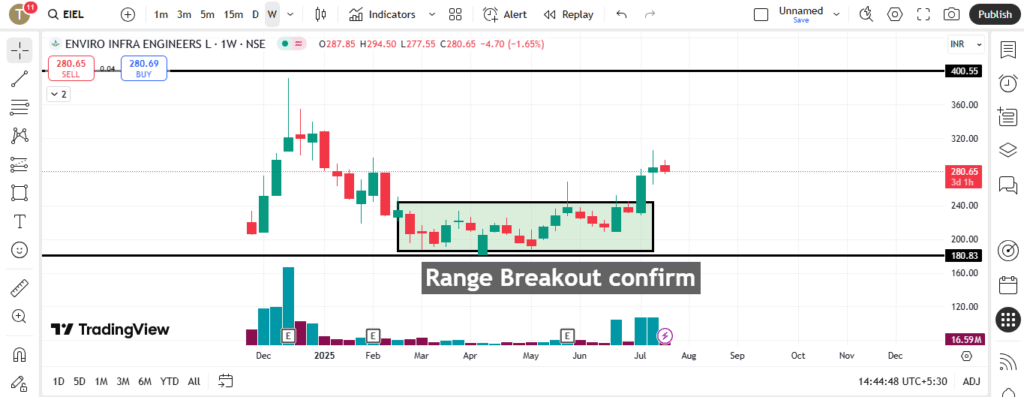

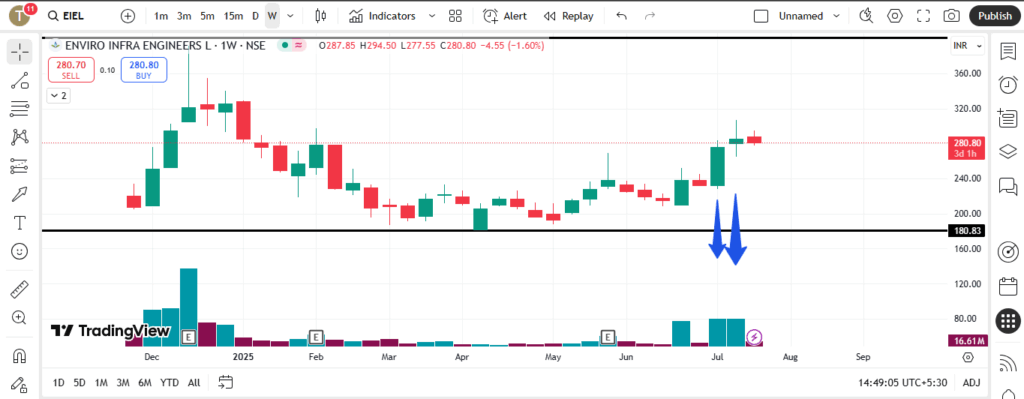

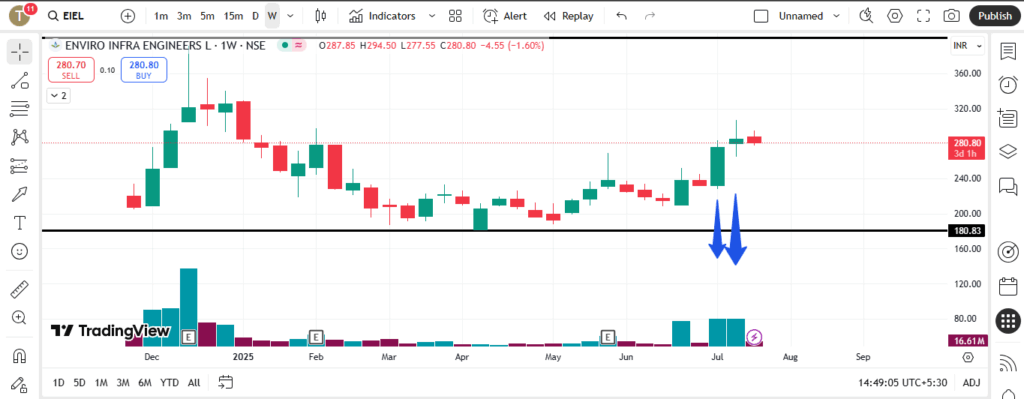

- Breakout confirmation: After consolidating between ₹230–₹300, EIEL has decisively broken above the range, signaling a fresh leg upward.

- Weekly support at ₹230: The stock has repeatedly bounced off this zone—a solid base for long-term traction.

- Surge in buying volume: Trading volumes have spiked above average, indicating institutional or “pro” accumulation ahead of a potential rally.

- Upside potential: With clearly defined support and strong breakout momentum, the ₹400+ target in 6–8 months looks realistic.

2. Company Snapshot & Market Position

Enviro Infra Engineers focuses on design, construction, and operation of water and wastewater treatment plants (STPs, CETPs, WSSPs), primarily for government and municipal bodies MarketScreener+15Screener+15ET Money+15. It has also ventured into renewable energy (solar installations at STP sites) and expanded via acquisitions such as EIEL Mathura and Saharanpur infra entities ICICI Direct.

- Market Cap: ₹4,900–₹5,000 crore (around $600–$620 million) ScreenerICICI Direct

- PE Ratio: ~28x ET Money+15Screener+15Tijori Finance+15

- ROCE / ROE: ~31.7% / 27.4% Screener

- Revenue / Profit FY25: ₹10,855 crore (

$1.32B) revenue; ₹1,763 crore ($214M) net profit MarketScreenerThe Economic Times - EBITDA margin: ~25% during the March quarter Screener+4Business Standard+4Yahoo Finance+4

3. Debt & Financial Stability

- Debt-free: As of the latest filings, the company holds ₹565 crore cash against only ₹234 crore of total debt—making it net cash positive Yahoo Finance.

- Low interest burden: Interest cost is just ~3.5% of revenue, signalling a lean capital structure Moneycontrol.

- Working capital: Days have expanded from 78 to ~139 days—something to watch, but EPS/WC trade-off currently manageable Screener.

4. Quarterly Growth & Profitability

Exceptional Q4 FY25 performance vs Q3 FY25:

- Revenue ₹393 crore (+59% QoQ, +31% YoY) Business StandardMoneycontrol

- EBITDA ~₹99 crore (+15% YoY, ~25% margin) ICICI Direct

- PBT ₹95 crore (+98% QoQ) Trendlyne.com+5Business Standard+5Moneycontrol+5

- PAT ₹73 crore (+100% QoQ, +27% YoY); EPS ₹4.89 Yahoo Finance+2Tijori Finance+2The Economic Times+2

FY25 vs FY24 (Annual):

- Revenue up ~47%, PAT up ~59% The Economic TimesMarketScreener

- 5‑yr PAT CAGR ~102%, ROE sustained over 27% ScreenerThe Economic Times

5. Shareholding & Institutional Interest

- Promoters: 70.09% stake, unpledged bajajbroking.in+7Trendlyne.com+7Trendlyne.com+7

- FIIs: Declining – from 0.65% → 0.33% Tijori Finance+4Trendlyne.com+4Trendlyne.com+4

- DIIs: Around 2.7% Trendlyne.comAngel One

- Mutual Funds: Small presence – ~1.3%, with LIC MF Value Fund holding ~1.22% Trendlyne.com+1ET Money+1

- Retail/Public: ~26.9% ICICI Direct+5Trendlyne.com+5Choice India+5

Summary: Promoters show strong conviction, while FIIs have slightly trimmed. MF and retail activity remains steady.

6. Why ₹400+ in 6–8 Months?

- Robust execution capabilities in water/waste-water infrastructure, a high-demand government focus sector.

- Clean balance sheet gives flexibility to bid larger contracts or fund capex.

- Accelerating revenue & profitability, sustained by ~25% EBITDA margins and >20% net margins.

- Technical breakout supported by volume; weekly support at ₹230 offers a strong risk buffer.

- Promoter and institutional alignment minimizes dilution and builds confidence.

7. Risks to Watch

- Working capital stretch: Growth in receivables and payables could pressure cash flows.

- Execution delays in government contracts may affect revenue recognition.

- Macroeconomic or policy changes in infrastructure funding.

- Valuation risk: Already trading at ~28x PE—further momentum may justify it, but any dip could test support.

Conclusion

Enviro Infra Engineers (EIEL) presents a compelling mix of strong fundamentals, clean finances, and technical breakout—ideal for investors targeting a ₹400+ rally in the next 6–8 months. With ₹230 as a sturdy support zone and Q4 momentum backing the narrative, initiating or adding positions seems timely. Monitoring execution and working capital trends remains crucial.

This content is for informational purposes only and should not be construed as investment advice. Please do your own research or consult your financial advisor before making investment decisions.