[share_icons]

Current Price: ₹517

52-Week High/Low: ₹635 / ₹282.20

Buying Zone: ₹540 – ₹550

Target: ₹800+

Duration: 8–12 months

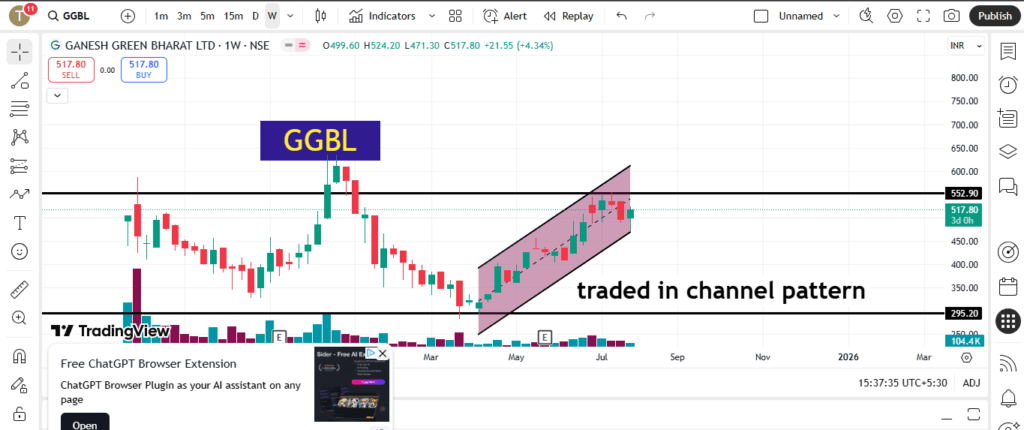

Ganesh Green Bharat Ltd (GGBL) is gaining investor attention after forming a strong double bottom pattern on the weekly chart—a classic bullish reversal signal. This technical setup, when combined with a rising channel pattern, gives traders and investors multiple confirmations of a potential breakout and sustained uptrend in the coming months.

Technical Analysis: Bullish Patterns Signal Breakout

- Double Bottom Pattern (Weekly Timeframe):

GGBL has recently completed a double bottom near its 52-week low. This pattern is considered a powerful signal for long-term trend reversals and often precedes major rallies. - Channel Pattern Support:

The stock has been trading inside a rising channel, bouncing off support zones and heading towards the resistance line. If the stock crosses the ₹550 zone with strong volume, it may test ₹800 levels in the next 8–12 months.

Company Overview: Solar & Infrastructure Focus

Ganesh Green Bharat Ltd, founded in 2016 and listed in 2023, is a fast-growing company in the renewable energy and infrastructure space. The company:

- Manufactures solar PV modules

- Executes solar EPC projects

- Handles water supply & smart metering projects across 14 states

- Delivered over ₹220 crore worth of projects

- Installed more than 2.5 lakh solar modules

Financial Performance & Fundamentals

Market Cap: ~₹1,230–1,280 crore

Debt-to-Equity Ratio: 0.88 – moderate debt

FY25 Revenue: ₹318 crore (up ~45% YoY)

FY25 Net Profit: ₹30 crore (up 100% YoY)

EPS (FY25): ₹12.5 approx

EBITDA Margin: 15–22%

ROE (Standalone): 33%+

ROCE (Standalone): ~30%

These strong numbers reflect impressive growth in profitability, suggesting the company is scaling well with increasing efficiency.

Valuation Metrics

- P/E Ratio: 39x – 42x

- P/B Ratio: ~20x (valuation premium compared to sector)

- Sector: Renewable energy & infrastructure

- Sector Avg. P/E: 20x – 30x

The stock trades at a premium, indicating strong investor sentiment and expected future growth. However, high valuations also demand continued earnings performance to sustain upside.

Shareholding Pattern

- Promoter Holding: 73.4% – Strong promoter control

- Public Holding: ~24–26%

- FIIs: 1.45%

- DIIs: 1.03%

Low institutional holdings suggest potential room for future entry by large investors, which could boost price.

Summary & Investment Outlook

| Factor | Details |

|---|---|

| Technical Setup | Double bottom + channel breakout |

| Buying Range | ₹540–550 |

| Target Price | ₹800+ |

| Timeframe | 8–12 months |

| Sector | Solar, EPC, Infrastructure |

| Growth & Profitability | Strong YoY growth, high margins |

| Risk | Moderate debt, high valuation |

Disclaimer:

This article is for informational purposes only and does not constitute investment advice. Stock investing involves risk. Please consult a SEBI-registered financial advisor before making any investment decisions. Past performance does not guarantee future results.