[share_icons]

Indian Energy Exchange Ltd (IEX), India’s first and leading power trading exchange, has been on the radar of smart investors for a while. With its near-monopoly position in a high-potential sector and strong fundamentals, IEX is now trading at a compelling valuation. Could this be the right time to enter?

Let’s break it down.

Stock Overview

- Company Name: Indian Energy Exchange Ltd (IEX)

- Current Market Price (CMP): ₹139

- 52-Week High: ₹244.35

- 52-Week Low: ₹131.50

- Ideal Buying Range: ₹113

- Stop Loss: ₹100

- Target Price: ₹300+

- Time Horizon: 12 to 15 Months

Why IEX Looks Attractive Now

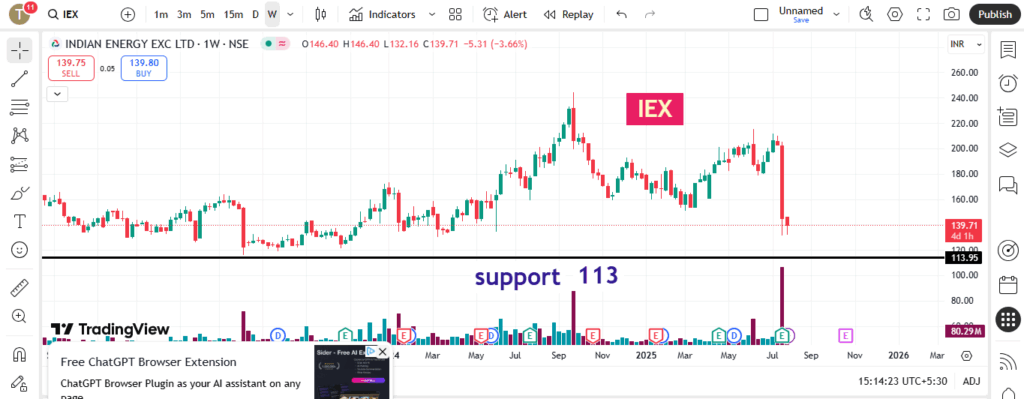

1. Strong Technical Support at ₹113

The ₹113 level has proven to be a strong support zone for IEX. The stock has bounced back multiple times from this zone, suggesting heavy accumulation by institutions and smart money investors. This makes it a good entry point for long-term buyers.

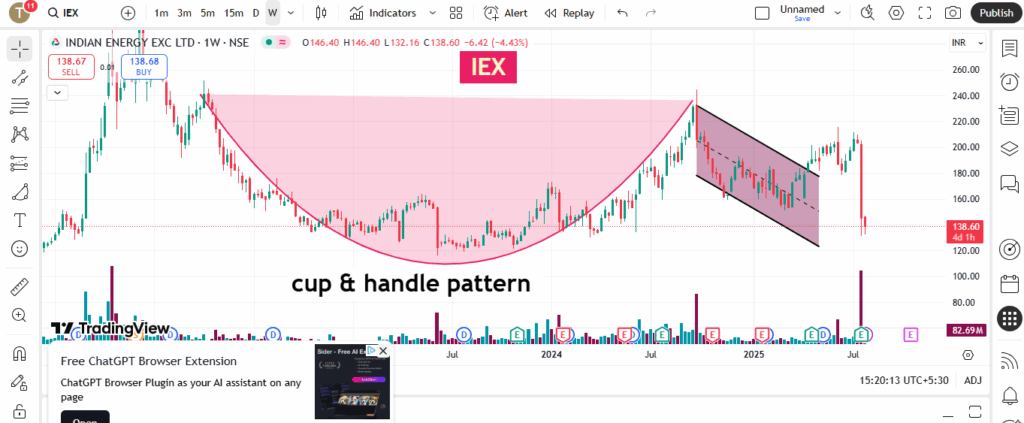

2. Technical Chart Hints at a Reversal

On the weekly chart, IEX recently formed a strong base pattern. The price action shows signs of consolidation and the beginning of a potential trend reversal. RSI is also recovering from oversold territory — an early bullish indicator.

3. Risk-Reward Ratio is in Your Favor

At ₹139, the downside is protected by support at ₹113 and a stop loss at ₹100. This makes the current level attractive for accumulating in tranches. On the upside, if the stock regains momentum, it has the potential to touch ₹300+ — offering a 100% return.

About Indian Energy Exchange Ltd

Indian Energy Exchange is India’s largest power trading platform. It facilitates the buying and selling of electricity, renewable energy, and energy-saving certificates. The exchange serves power distribution companies (discoms), industrial units, and open-access consumers. It operates with minimal risk, high efficiency, and strong operating margins.

Key Strengths:

- Debt-Free Balance Sheet

- High Profit Margins

- Scalable Technology Platform

- Regulatory Backing

- Near Monopoly Status

Fundamental Strength

IEX has maintained a strong performance over the past few years:

- Revenue: ₹400+ Cr annually

- Profit Margin: Over 60%

- Operating Model: Asset-light and tech-driven

- Dividend Payouts: Consistent returns to shareholders

With India’s growing electricity demand, clean energy targets, and need for transparent energy pricing, IEX stands to gain significantly.

Risks and Challenges

No investment is without risk. Here are a few things to keep an eye on:

- Regulatory Uncertainty: Any change in electricity market rules could impact IEX operations.

- Rising Competition: While IEX currently leads the market, new exchanges could emerge.

- Volatility: Power consumption patterns can fluctuate due to seasons or economic slowdown.

Despite these risks, the long-term story remains intact.

Investor Strategy – How to Play IEX Now

Here’s how smart investors are approaching IEX:

- Start Accumulating in the ₹113–₹139 range

- Keep a strict stop loss below ₹100

- Hold for 12–15 months with a target of ₹300+

- Reassess if it breaks ₹170 with strong volume — a sign of breakout

Final Thoughts

IEX offers a rare combination of strong fundamentals, technical support, and sectoral tailwinds. While the stock has corrected from its 52-week highs, the current consolidation phase could be a blessing in disguise for long-term investors.

If you believe in India’s power sector growth story and want to invest in a capital-efficient, cash-rich company, Indian Energy Exchange Ltd deserves a place on your watchlist — or even in your portfolio.

Disclaimer:

This blog is for informational purposes only and not a recommendation to buy or sell any security. Always consult your financial advisor before making investment decisions