[share_icons]

52-Week High: ₹528.50

52-Week Low: ₹390.15

Current Market Price (CMP): ₹414 (approx.)

Buying Zone: ₹410–₹420

Stop-Loss: Below ₹370

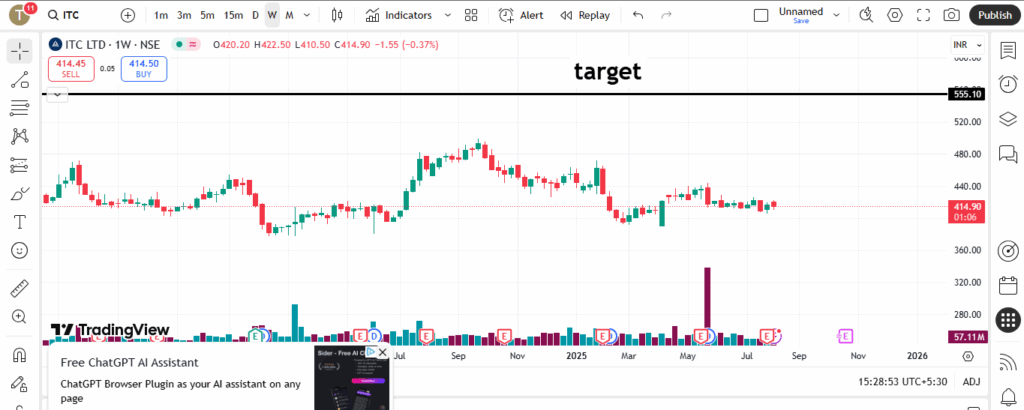

Target (12–18 months): ₹550–₹650

Technical View: Why ITC Looks Attractive Now

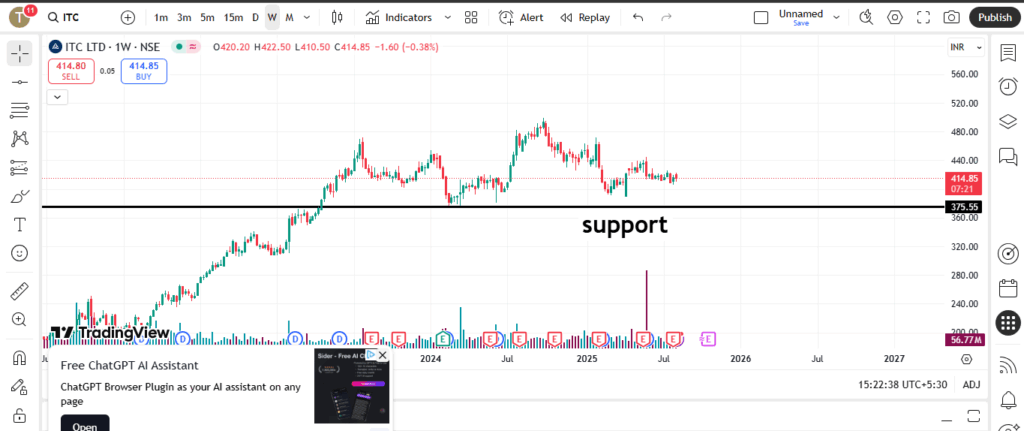

1. Strong Weekly Support Around ₹380

On the weekly timeframe, ITC has consistently found strong buying support near ₹380. This level has been tested multiple times over the past year without a decisive breakdown, showing that long-term investors and institutions are keen to accumulate in this zone. With the stock now trading near ₹414, we are just above that key support — making this an attractive buy-on-dip opportunity.

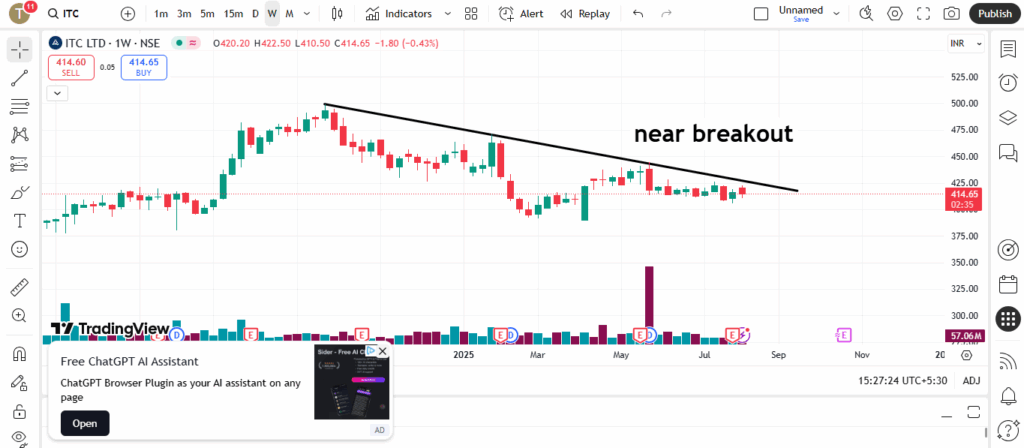

2. Trendline Setup – Potential Breakout Ahead

A clear upward trendline has been guiding ITC’s price action over recent months. Price consolidations along this line have often been followed by sharp rallies. Right now, the stock is testing the trendline resistance in a coiling pattern. If the price closes above this resistance with strong volumes, it could “fire” to the upside, unlocking the potential for a breakout move toward ₹550–₹650 over the next 12–18 months.

Company Overview

ITC Ltd is one of India’s largest diversified conglomerates with businesses across FMCG, Hotels, Paperboards & Packaging, Agri-Business, and Cigarettes. Founded in 1910, it has grown to become a market leader in cigarettes, packaged foods, personal care, and several other consumer product categories. Its flagship FMCG brands include Aashirvaad, Sunfeast, Bingo!, Yippee!, Fiama, Savlon, and Classmate.

Fundamental Snapshot

| Metric | Value / Insight (FY25 approx.) |

|---|---|

| Market Cap | ~₹5,15,000 crore |

| P/E Ratio | ~23–24× |

| P/B Ratio | ~6.6× |

| Debt-to-Equity | 0.00 (Debt-free) |

| ROE | ~24% |

| ROCE | ~33% |

| Dividend Yield | ~3.3% |

| Promoter Holding | 0% (Professionally managed) |

| FII Holding | ~42% |

| DII Holding | ~44% |

| Public Holding | ~14% |

Financial Performance

- Revenue Growth: ITC has delivered steady mid-single-digit revenue growth over the past three years, despite economic headwinds. FY25 revenues crossed ₹70,000 crore.

- Profit Margins: ITC maintains one of the highest profit margins in the FMCG sector, driven by its cigarette segment and strong pricing power.

- Debt-Free Balance Sheet: The company has zero debt and large cash reserves, giving it flexibility for expansions, acquisitions, and sustained dividend payouts.

- Dividend Policy: ITC is known for rewarding shareholders with high and consistent dividends. Over the past five years, it has distributed significant cash while still investing in growth.

Sector Context

ITC operates in multiple sectors, but FMCG is its fastest-growing segment outside cigarettes. The broader Indian FMCG sector trades at a P/E of ~60×, while ITC trades at around 23–24× — indicating a valuation discount compared to peers like HUL, Nestle India, and Britannia. This discount is partly due to its cigarette business, but for value investors, it presents a compelling entry.

Why ITC Looks Strong for Medium-Term Holding

1. Technical Confluence

The ₹410–₹420 range aligns with both horizontal price support and the ascending trendline, making it a high-probability accumulation zone for medium-term investors.

2. Consistent Growth with Stability

While some FMCG players face volatile margins, ITC has diversified revenue streams, with cigarettes funding expansion into high-growth packaged foods and personal care products.

3. Institutional Confidence

With over 86% of ITC’s shares held by FIIs and DIIs, the stock enjoys strong institutional backing. This institutional ownership helps stabilize the stock during market corrections.

4. Attractive Dividend Yield

At ~3.3%, ITC’s dividend yield is among the best in large-cap FMCG, providing steady income while you hold for capital appreciation.

5. Potential Catalysts

- Expansion in non-tobacco FMCG segment with high growth potential.

- Continued strength in Agri-business exports amid global commodity demand.

- Recovery in Hotels segment as tourism and business travel surge.

Risk Factors to Watch

- Regulatory Risk: Cigarette business is vulnerable to higher taxes and stricter regulations.

- Competitive Pressure: FMCG space is competitive, with peers pushing hard on pricing and innovation.

- Slow Breakout Confirmation: If the trendline breakout fails, the stock could consolidate longer before resuming its upward trajectory.

Investment Strategy

Given the technical and fundamental setup, here’s a potential plan:

- Buy Zone: Accumulate between ₹410–₹420.

- Stop-Loss: Below ₹370 to protect capital in case of adverse moves.

- Target: ₹550–₹650 over the next 12–18 months, implying an upside of ~33%–57% from current levels.

- Position Sizing: Allocate as per your risk profile; consider staggered buying to average in.

Historical Perspective

In the last decade, ITC has had periods of consolidation followed by sharp rallies. For example:

- Between 2014–2017, the stock rallied over 70% before a multi-year consolidation.

- The recent 5-year period saw steady growth in earnings but range-bound prices, creating a long base — historically, such patterns have preceded sustained uptrends.

Summary Table

| Parameter | Details |

|---|---|

| CMP | ₹414 |

| Buy Zone | ₹410–₹420 |

| Stop-Loss | Below ₹370 |

| Target | ₹550–₹650 |

| Duration | 12–18 months |

| Market Cap | ₹5.15 lakh crore |

| P/E Ratio | ~23–24× |

| Sector P/E | ~60× (FMCG) |

| Debt | Debt-free |

| Dividend Yield | ~3.3% |

| Promoter Holding | 0% |

| FII Holding | ~42% |

| DII Holding | ~44% |

| Public Holding | ~14% |