[share_icons]

Vodafone Idea Ltd (VIL), one of India’s leading telecom service providers, has been under immense pressure over the past few years due to financial struggles, intense market competition, and mounting debt. However, with improving fundamentals and strategic initiatives, the stock is once again catching investor attention.

Let’s delve into the complete analysis of the stock – covering its technicals, fundamentals, and market position.

Key Technical Highlights

- 52-Week High: ₹16.55

- 52-Week Low: ₹6.29

- Current Market Price (CMP): ₹6.91

- Buying Zone: ₹6.5 – ₹7.5

- Target Price: ₹12 – ₹16

- Time Horizon: 12 – 18 Months

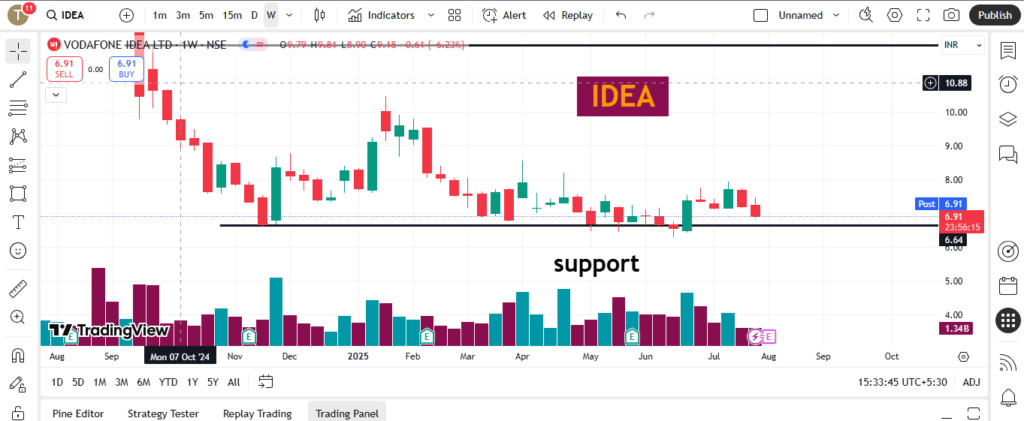

- Nearest Support Zone: Vodafone Idea is currently trading near a major support level. This gives a strong base for long-term investors looking for entry points.

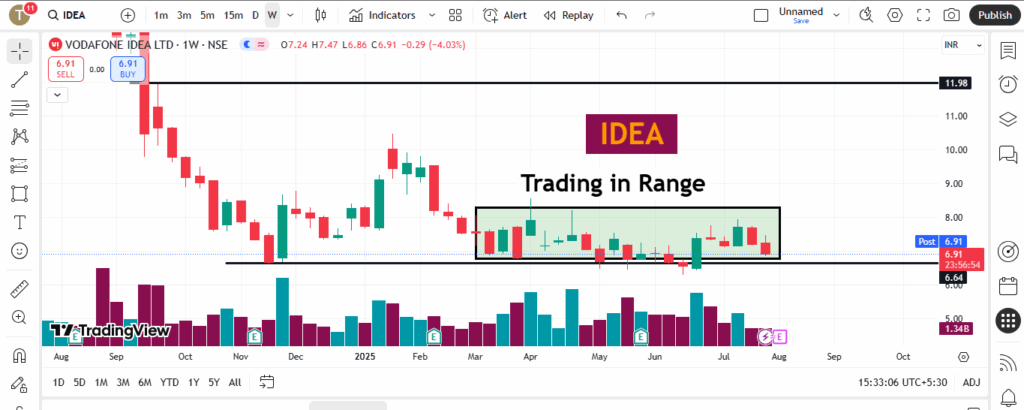

- Range-Bound Breakout Setup: On the weekly time frame, the stock has been consolidating in a range. A breakout from this range can trigger a fresh bullish rally, initiating a new upward trend.

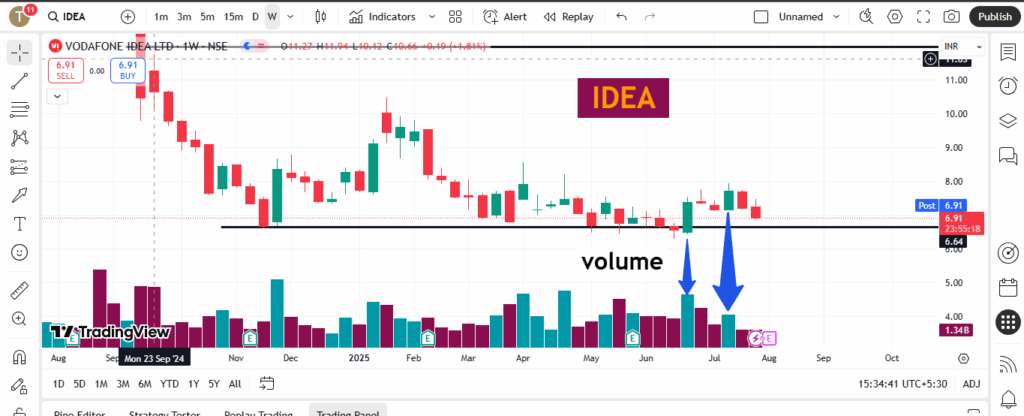

- Volume Confirmation: Recent weeks have seen a surge in buying volumes, suggesting accumulation by investors, which is often a precursor to a strong price move.

Company Overview

Vodafone Idea Ltd is a result of the merger between Vodafone India and Idea Cellular in 2018. It is a leading telecom operator offering voice and data services across 2G, 3G, and 4G platforms, catering to both retail and enterprise customers. The company operates under the brand “Vi”.

- Industry: Telecommunications

- Founded: 2018 (Post Merger)

- Headquarters: Mumbai, Maharashtra

- Brand: Vi (Vodafone Idea)

Fundamental & Financial Analysis

1. Market Cap & Valuation

- Market Capitalization: ₹33,500+ Crores (as of July 2025)

- Stock P/E (Price-to-Earnings): NA (Negative earnings)

- Sector P/E (Telecom): ~35

Vodafone Idea is still reporting losses, so the P/E ratio is not applicable. The sector, however, remains strong with a favorable outlook.

2. Debt Status

- Highly Leveraged: The company has a significant debt burden of over ₹2 lakh crore, including AGR dues, spectrum payments, and loans.

- Relief Measures: Government relief packages and conversion of dues into equity have offered temporary stability.

- Capex Challenge: Despite relief, VIL still needs substantial funding to expand and sustain its 4G/5G rollout.

3. Promoters & Shareholding Pattern

- Promoters Holding: ~50%

- Public Holding: ~39%

- FIIs (Foreign Institutional Investors): ~2.5%

- DIIs (Domestic Institutional Investors): ~7%

Promoters continue to support the business, while increasing DII participation shows growing confidence among local institutional investors.

4. Quarterly Results & Growth

- Q4 FY25 Revenue: ₹10,600 Crores (approx)

- EBITDA Margin: ~38%

- Net Loss: ₹6,400 Crores (narrowed from previous quarters)

- ARPU (Average Revenue Per User): ₹145, showing improvement

Though the company is still loss-making, revenues and ARPU are gradually increasing, indicating a slow turnaround.

5. Sales & User Base

- Total Subscribers: ~215 million

- Active Users: ~90%+

- 4G User Base: Increasing, but still lags behind Jio and Airtel

- Churn Rate: Stabilizing as customer services and network quality improve

Investment Outlook – Should You Buy?

Vodafone Idea is undoubtedly in a high-risk zone due to its financial structure and debt. However, it presents a high-risk, high-reward opportunity for long-term investors.

Reasons to Consider Buying:

- Stock is near support with bullish technical setup

- Buying volumes indicate strong interest

- Telecom sector has long-term growth potential

- Government backing provides some level of safety net

- If VIL manages to raise funds or improve operational efficiency, stock may deliver multi-bagger returns

Risks to Watch:

- Heavy debt burden remains a major concern

- Delays in 5G rollout or funding can impact performance

- Negative cash flow and continued losses

Conclusion

Vodafone Idea’s stock at current levels of ₹6.91 appears attractive from a technical standpoint, especially for positional traders. From a fundamental view, it is a speculative bet with the potential for strong returns if the company executes its recovery plan effectively. Investors with high-risk appetite and long-term horizon may consider entering in the ₹6.5–₹7.5 range with targets of ₹12–₹16 over the next 12–18 months.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Investors should consult their financial advisors before investing.